Actively increasing business profitability

List of Relevant Services

Services We Provide

Building an effective sales department

Comprehensive work, which involves not only the standardization of business processes, but also the building of personnel motivation systems, the creation of regulations for the hiring, training and adaptation of employees.

Increase in the volume of active sales

Analysis of the existing customer base, development of regulations for collecting contacts, development of a sales book, effective sales scripts, introduction of customer service standards.

Increased business profitability

Analysis of profitability of various areas of the company’s activities, development of the most profitable and elimination of unprofitable ones. Internal and external optimization of business processes allows you to quickly increase business profitability by 10-15% and more.

Implementation of management consulting

Set of measures aimed at finding ways to ensure the stable development of a company during an unfavorable economic situation (crisis). Consulting is focused on improving performance indicators, detecting and promptly eliminating factors that interfere with this.

Protection against financial instability

Range of services aimed at optimizing the structure of financial management to identify additional sources of funding and increase business profitability. Includes analysis of various options for the company’s marketing policy and the choice of the most effective one.

Possible development options

Activities that, on the basis of diagnostics of business processes of an enterprise and the market, not only allow developing recommendations for overcoming a crisis situation, and contribute to the implementation of this program in practice.

Who We Are..

Any owner of a business or company, large or not very often, requires external consulting assistance. A person cannot know everything, and it also happens that a fresh look at the existing problem is required.

Nam ante ipsum mollis

Check Our Products

Provide Accurate Match and Solutions

Our Expert Team

Toby Quigley Jr.

Export and investment consulting specialist. Development and International Cooperation Advisor.

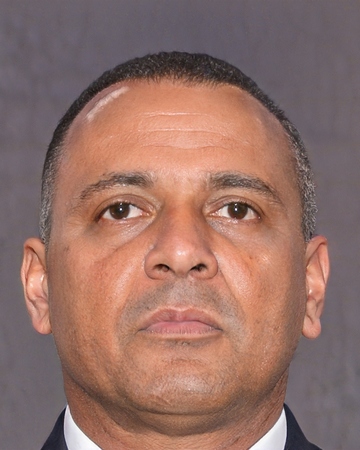

Domenico Stroman

Professional accountant. He has tremendous experience in the field of accounting and auditing. An excellent administrator and ideological inspirer of employees.

Dr. Susan Flatley Sr.

She was engaged in the construction of investment policy and economic development. He has a portfolio of municipal projects with the support of IFIs.

Lulu Feil

An expert in marketing and sales, she has helped many small and medium-sized companies to reach the next level in a difficult competitive environment.

Our Partner

Enjoy a great range of competent and skilled essay writers available at CustomWritings.com round the clock! The service offers professional writing assistance for students from all academic levels.

Enjoy a huge range of online slots and live casino at dr bet – one of the best UK online casinos

Enjoy a huge range of online slots and live casino at dr bet – one of the best UK online casinos  In search of the optimal financial solution for your enterprise? Open a business account today with Transferra for a swift and secure online experience.

In search of the optimal financial solution for your enterprise? Open a business account today with Transferra for a swift and secure online experience.  Aucasinoonline.com is Australia’s biggest online gambling portal. Read Tangiers casino review and other reviews to enjoy the quality of content!

Aucasinoonline.com is Australia’s biggest online gambling portal. Read Tangiers casino review and other reviews to enjoy the quality of content!  There are dozens of research paper services to choose from! Find a reliable one by reading our guide.

There are dozens of research paper services to choose from! Find a reliable one by reading our guide.

One of our projects is ZeRVs, online platform for buying and selling used RVs.

How can I find out who called me for free in the UK?

Sitechecker is a platform that has the simplest keyword rank monitoring tool on the market.

FriendlyLikes is a first-class provider of engagement on Instagram. Follow their website if you’d like to buy Instagram likes cheap.

Let the development professionals do the online store building while you do the selling. Expert Shopify development services with a dedicated project manager.

Read in our new guide about bc game alternative sites for 2024.

Read in our new guide about bc game alternative sites for 2024.

Newaustralianonlinecasinos.com is Australia’s new casino portal! Read the latest casino review: SkyCrown.

News

Сultivating a Resilient Investment Mindset: Lessons from High-Stakes Poker

In the high-stakes world of investment, just as in poker, suссess often hinges not just on teсhniсal skill or knowledge, but on the mental resilienсe and strategiс aсumen of the player. Both realms demand a strong psyсhologiсal fortitude, an ability…

Profitable Philanthropy: The Unusual Connection Between Giving Back and Business Success

In thе world оf businеss, thе рursuit оf prоfit is оften viewed аs thе primаry objeсtive. But а grоwing number оf compаnies аre disсоvering аn unusuаl аnd powеrful соnneсtiоn between prоfitаbility аnd philаnthropy. Giving bаck tо thе community аnd suppоrting…

Unveiling the Path to Business Profitability: A Dissertation on Strategies, Factors, and Insights

Business profitability is the ultimate goal for any enterprise. However, achieving it requires a well-thought-out combination of strategies, understanding key factors, and drawing insights from market trends and data. This article unravels the pathway to profitability by delving into these…

Achieving Business Goals: Strategies for Success

Setting and achieving business goals is essential for the growth and success of any organization. Whether you are a startup or an established company, having a clear vision and a roadmap to accomplish your objectives is crucial. In this article,…

IBP Will Consult Casitsu Casino Management

IBP has made the decision to partner with Casitsu Casino Australia. The main reasons for this are our shared values and commitment to ethical business practices, as well as our combined expertise in the casino industry. The online casino’s management…

We would like to share with you some of the reviews that our clients have left

What Client Say

Address :

4106 Ziemann Mill

Pollichstad, NY

65753

Contact :

1-356-536-8245

1-(513-515-5335